ev tax credit 2022 reddit

2022 EV tax credit need to increase federal taxes to offset. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy.

New Us Ev Tax Credit Here S Everything You Need To Know

Assuming theres no retroactive credit under the new bill would EV buyers in early 2022 Jan Feb still get tax credit under the old bill with the same manufacturer cap restrictions.

. I think I will. New battery electric cars that cost more than 55000 do not qualify for the EV tax credit. Todays Car News Bengt Halvorson November 14 2022 Toyota has teased the 2023 Prius but were still.

I could get a federal tax credit of 6800. From what I saw if you make more than 150K single or 300K joint you cant get the credit. Used EVs will get a tax credit.

From the November 2022 issue of Car and Driver. Ordered a bmw x45e that currently qualifies for the 7500 tax credit. To add more background on the tax credit amount.

Also if the MSRP is above 55K you. It is not a blanket 7500 and no vehicles will likely qualify for the full 7500 immediately. Toyota Motor Sales USA.

Looking at last minute increases in federal tax debit to offset EV tax credits. On August 15 about 30 new EVs and 42 plug-in hybrids were eligible for federal income-tax credits. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation.

BYD has sold over 14 million EVs this year and is launching a new premium brand called Yangwang meaning looking up. The first vehicle is an off-road vehicle and will be. 3750 for a North American made battery.

This potential change to the EV tax credit is one of many items included in Bidens proposed Build Back Better Framework. Price matters but not until January 1. The credit is non-refundable which means you will only get a credit against your tax liability up to your tax.

On August 16 those. Cars assembled in North America can qualify for up to 7500 in federal EV tax credits 3750 if the battery components were built in North America and 3750 if critical. What happens if new ev tax credit or rebate laws are passed in 2022.

November 13 2022 at 800 am. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. The incentives had been proposed to go as.

The remarks represent a reversal of sorts for the car maker as Tesla CEO Elon Musk had spoken out against proposed electric vehicle tax credits in the last year. When you prepare your 2021 tax return there is a form to claim the credit. On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower.

The 2022 Toyota Prius Prime starts at 28220. It wont be delivered until feb 2022. The credit is 30 of the price up to 4000 whichever is less.

Beginning January 1 however those credits will be capped at 150000 income for a single filing taxpayer and 300000 for joint filers. The Inflation Reduction Act includes complex new rules governing the 7500 federal tax credit available to taxpayers who. Federal EV Charging Tax Credit.

The model year must be at least two years earlier than the calendar year its purchased. 2023 will also usher in limits on qualifying. 1 2023 consumers might be eligible for the tax credit for used or previously owned cars in addition to new EVs and businesses might be eligible for a new.

That price threshold rises to 80000 for new. It would add 4500 to the existing 7500 for any plug-in EV made in. By Peter Douglas.

Tesla charging connector 2023 Toyota Prius EV tax credit delay. Following this same projected timeline beginning October 1 2022 purchases would qualify to. Also will depend on your income and the MSRP of the car.

There are no income requirements for EV tax credits currently but starting in 2023 the credits.

No Ev Tax Credit If You Earn More Than 100 000 Says Us Senate Ars Technica

These 34 Electric Cars Won T Qualify For Biden S New Ev Tax Credits Carscoops

Us Inflation Reduction Act Ev Tax Credit Megathread Part 2 R Electricvehicles

Joe Manchin Calls Ev Tax Credits Ludicrous In Senate Hearing Ars Technica

![]()

Ev Tax Credits Thoughts R Cars

No More Federal Ev Tax Credit For Ioniq 5 Ev6 And Gv60 R Ioniq5

Us Inflation Reduction Act Ev Tax Credit Megathread Part 2 R Electricvehicles

How These Top Selling Electric Cars Could Be Affected By New Tax Credit Autoblog Autoblog

New Details On Ev Credits In Reconciliation Bill R Electricvehicles

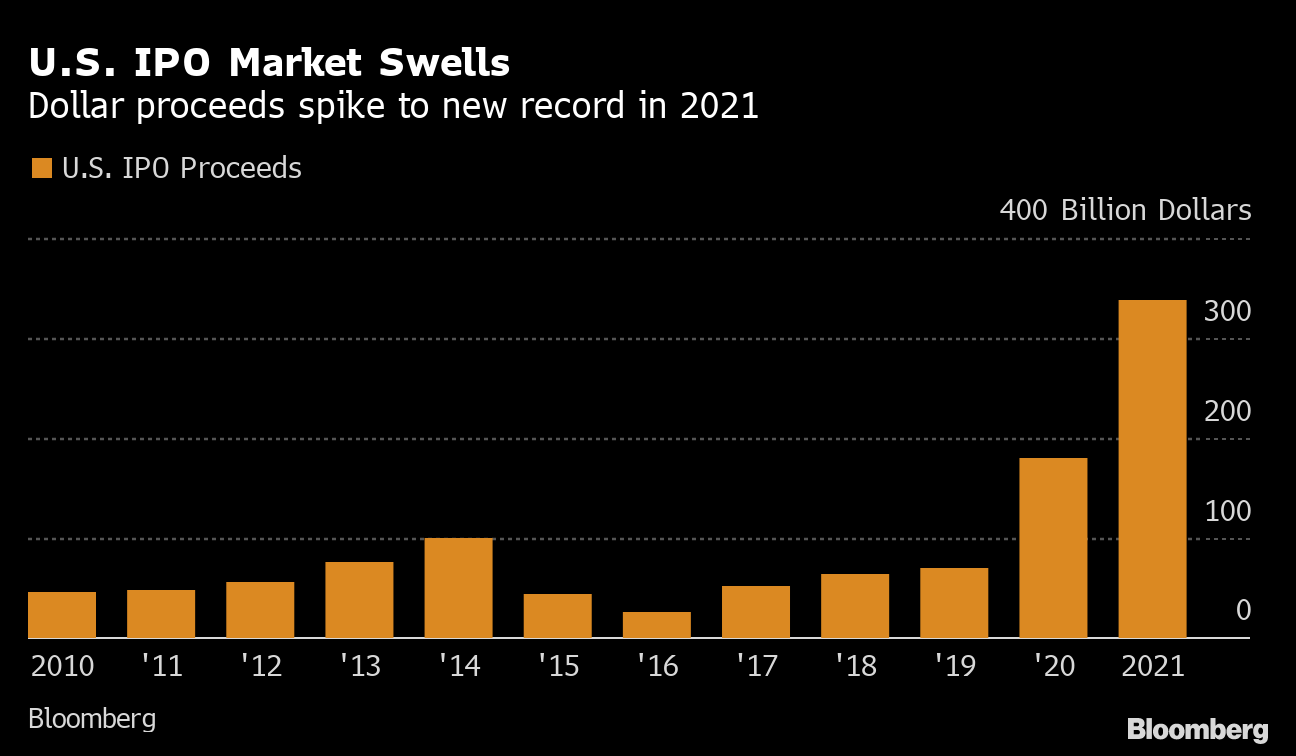

Reddit Tpg Partners Highlight Crowded 2022 Ipo Pipeline Bloomberg

Every Electric Vehicle That Qualifies For Us Federal Tax Credits

These Are The Only 21 Vehicles That May Be Eligible For Biden S New Ev Tax Credits Carscoops